Published on:

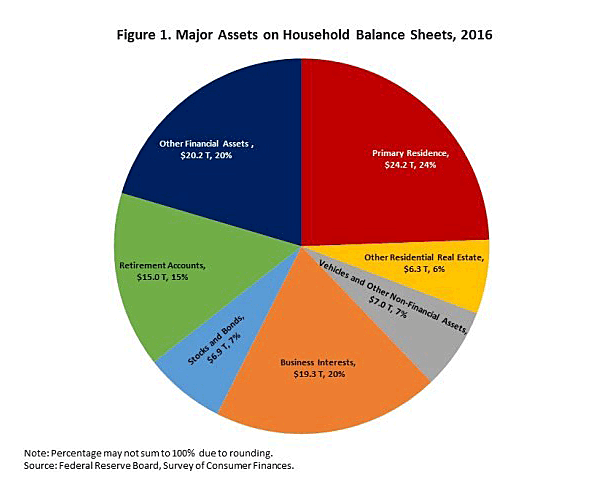

Homeownership – more than any other financial asset – is key to household wealth, accounting for nearly one-fourth of all assets held by households in 2016. The Survey of Consumer Finances (SCR) valued assets made up of primary residences at $24.2 trillion.

Three additional categories accounted for another 55 percent of a household’s balance sheet:

- Other financial assets ($20.2 trillion; 20 percent), described as including loans from the household to someone else, future proceeds, royalties, futures, non-public stock, deferred compensation, oil/gas/mineral investments, and cash, not elsewhere classified;

- Business interests ($20.2 trillion; 20 percent); and

- Retirement accounts ($15 trillion; 15 percent).

The remaining assets, with a combined value of about $20.1 trillion, included stocks and bonds (7 percent); vehicles and other non-financial assets (7 percent); and other residential real estate (6 percent).

Researchers with SCF noted the distribution of major assets on household balance sheets varies by age group. For example, in households whose members are under age 55, the aggregate value of the primary residences was the largest asset category on the balance sheet. Among households between ages 55 and 64, business interests and other financial assets were the largest categories, with the primary residence in third place. For households aged 65-plus the primary residence became the second largest asset category (behind other financial assets) as business interests shrunk.

The Survey of Consumer Finances (SCF) with family-level data, is published every three years by the Board of Governors of the Federal Reserve System. A different survey, the quarterly Financial Accounts of the United States (previously known as the Flow of Funds Accounts), provides aggregate information on household balance sheets.