Published on:

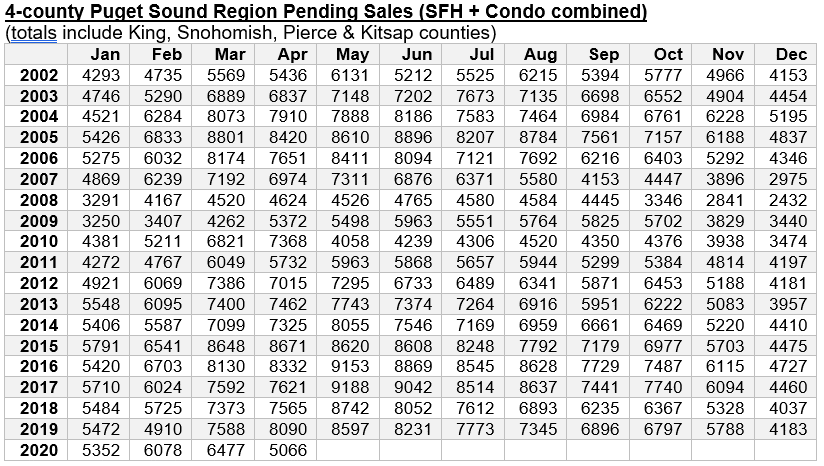

KIRKLAND, Washington (May 6, 2020) – Residential real estate activity around Western Washington reflected expected declines during April with the impact of the coronavirus pandemic taking its toll. A new report from Northwest Multiple Listing Service shows year-over-year (YOY) drops system-wide in new listings, pending sales and closed sales, but prices increased nearly 6.4%.

“With the first full month of post-COVID-19 data in hand, it’s clear the Puget Sound housing market has been hit but not knocked out,” stated Windermere Chief Economist Matthew Gardener. “The normally active spring market is significantly slower than normal due to COVID-19, but it has not come to a halt,” he observed, adding, “In my opinion, it is responding to the current circumstances exactly as expected.”

Some industry veterans expected more severe declines. “As we look at the numbers for April, typically one of the most active months in regard to new listings, the impact of COVID-19 on the real estate market is now clear, although I personally thought it could have been worse,” remarked Mike Grady, president and COO at Coldwell Banker Bain.

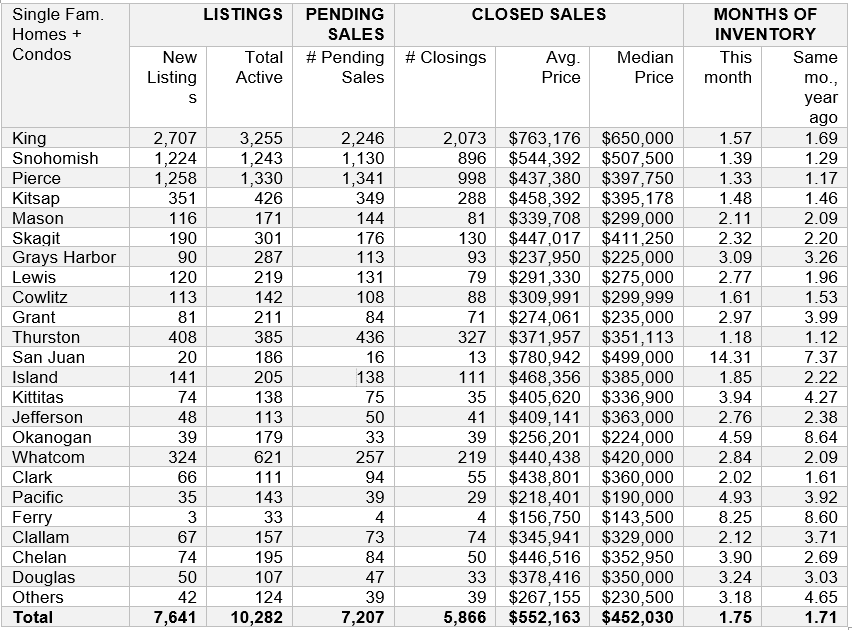

The Northwest MLS report for April shows area-wide inventory fell nearly 21% from a year ago, dropping from 12,955 listings to 10,282. A comparison of the 23 counties in the report shows only four counties with YOY increases (Jefferson at 0.9%, Whatcom at nearly 6%, Douglas at 13.8% and Lewis at 17.7%), while three counties had shrinkages of around 30% or more (King at -29.6%, Clallam at -32.9% and Island at -39.2%).

The volume of new listings added during April was off 34.7% compared to the same month a year ago. Brokers added 7,641 new listings last month, down from both March when 10,291 new listings were added, and April 2019 when brokers added 11,697 new listings.

Despite the slower activity, the months of supply improved only slightly, rising from the March figure of 1.4 months to 1.75 months of inventory at the end of April.

J. Lennox Scott, chairman and CEO of John L. Scott Real Estate, described the market as “virtually sold out everywhere locally in the more affordable and mid-price ranges.” Commenting on the local market, he said, “We are seeing buyer demand coming forward. With historically low interest rates, the local market needs additional listings to meet pent-up demand from the backlog of buyers,” he stated.

“We continue to see a shortage of inventory, along with multiple offers on newly listed homes, and we still have a backlog of buyers who line up (virtually) to view new listings,” reported Frank Wilson, branch managing broker at Kitsap regional manager at John L. Scott Real Estate. “With exceptionally low interest rates, there is no change in sight,” he suggested.

Gary O’Leyar, designated broker/owner at Berkshire Hathaway HomeServices Signature Properties, reported seeing “only a slight increase in average market time for some listings,” along with “instances of multiple offers.” Acknowledging it was anyone’s guess as to how the March 25 “Stay Home, Stay Healthy” orders would play out, he suggested the Greater Seattle real estate market “continued to show its fundamental strength in April.”

In comparing April to March in the tri-county area (King, Pierce and Snohomish counties), economist Gardner noted the total number of active listings rose (up 14,8%), but new listings dropped (down 25.5%), which he said suggests sellers may be waiting until the shelter-in-place order is over. In the same area, home prices were essentially flat, which Gardner said, “This tells me that sellers are having realistic expectations about value and buyers, hoping for deep discounts, are not finding them.”

Wilson agreed, reporting, “We have had quite a few buyers who have come into the market thinking this is a good time to make lower offers on houses, but that is just not the case in Kitsap County.” Northwest MLS figures show the median price for homes and condos that sold last month in Kitsap County rose more than 13% from a year ago, from $349,500 to $395,178.

Another broker in Kitsap County, Frank Leach, broker/owner at RE/MAX Platinum Services in Silverdale, attributed part of that area’s 35% drop in pending sales to COVID-19 restrictions affecting showings. Nevertheless, his analysis showed more than half the sales in Kitsap County were over the asking price. “The market continues to be very competitive,” he stated.

Eight other counties, like Kitsap, reported double-digit jumps in median sales prices compared to a year ago, while four counties had declines.

In King County, prices rose 4% from a year ago, from $625,000 to $650,000. Snohomish County prices were up nearly 6% and Pierce County joined Kitsap with a double-digit gain; prices there increased from $355,000 to $397,750 for a 12% gain.

System-wide, prices were up about 6.4%, rising from the year-ago figure of $424,950 to last month’s figure of $452,030. Year-to-date prices are up nearly 9.3% compared to twelve months ago.

“With peripheral areas still showing price increases higher than the Seattle area core, April’s figures highlight the trend of migration to outer suburban areas, along freeway corridors,” suggested James Young, director at the Washington Center for Real Estate Research (WCRER). He also believes the figures illustrate “a continued preference for lower density areas given the likely persistence of distancing measures in the future. The virus has refocused many potential buyers, especially for those owning high-density properties in Seattle and elsewhere, on more space and less density. It makes social distancing easier!”

Young expects the trend of households moving to outer counties will likely accelerate in the coming weeks. “Older households in Seattle and other urban centers will be attracted to lower density areas because it is easier to maintain social distance while possibly gaining more space at a lower price point. As long as older householders in urban areas are able to sell, other counties will continue to see increased prices,” he stated.

Changes in lending practices could influence activity according to some market watchers, including Young. “The biggest factors in mortgage markets are first-time buyers, who may not qualify under new criteria, and jumbo markets,” he remarked.

Broker Dean Rebhuhn, owner at Village Homes and Properties, also commented on shifts in financing. “When the pandemic struck, fear came to play with sales under contract. Buyers became concerned, banks became concerned, appraisers became concerned,” according to Rebhuhn. Some buyers terminated their transactions, in some cases even forfeiting deposits. Nationwide lenders tightened their polices, he noted adding, “Jumbo loans became much harder to obtain, as did home equity loans and refinances.”

Rebhuhn said noticeable changes occurred in mid-April. “New lenders saw opportunities in the market-place and filled the space left by the national lenders. Sellers and buyers became more active,” he reported, adding, “It is amazing how resilient the real estate market has become in the face of the new normal.”

Other representatives from Northwest MLS echoed comments by Rebhuhn.

“Buyers are relying more and more on technology and tools to allow for virtual open houses and viewings. Social distancing, face masks, showings by appointment only and only two people in a home at a time with one of them being the broker are the new norm,” stated Wilson. Like WCRER’s Young, he said he could imagine homeowners wanting to change their living conditions to accommodate for more room or more outdoor space. “This could well cause a shift in what buyers are looking for in the future.”

Leach also reported, “Buyers in Kitsap County are very active on the internet and are checking out properties the minute they go on the market,” with corresponding surges in activity at title companies and by lenders. “Virtual tours are getting a lot of attention.” He said homebuilders “are ready to go full steam ahead.”

Grady also observed upticks in activity and optimism. In tracking their company numbers since March 29, he said they’ve averaged about a 10% increase in production (new listings, new transactions, and closed sales) in each subsequent week. He expects activity will continue to increase throughout May and June, which he says, “speaks to a market that is slowly adjusting to new ways of operating.”

“Optimism is rising,” Grady reported. “We have seen a drastic increase in views of virtual tours.” He also believes consumers are gaining confidence around safety measures for touring homes and as brokers become more adept at hosting live stream open houses. “Buyers are utilizing virtual technology, electronic signatures, and remote online notary processes for closing. All in all, we’re getting through this together,” he proclaimed, adding, “We are truly fortunate to live in a region that has navigated this crisis as adeptly as possible.”

About Northwest Multiple Listing Service

As the leading resource for the region’s residential real estate industry, NWMLS provides valuable products and services, superior member support, and the most trusted, current residential property and listing information for real estate professionals. NWMLS is a broker-owned, not-for-profit organization with more than 2,500 member offices and 30,000+ real estate brokers in Washington state and Oregon. NWMLS operates regional service centers throughout its coverage area, providing dedicated support to its members and fostering a robust, cooperative brokerage environment.

NWMLS offers a home listing search and comprehensive broker database at https://www.nwmls.com.

Other resources: