Published on:

During an information-packed presentation to members of the Governmental and Public Affairs Committee of the Seattle King County REALTORS®, King County Assessor John Wilson explained what his office does, how property values are set, how property taxes are calculated, differing values in a sampling of cities, and exemptions for seniors.

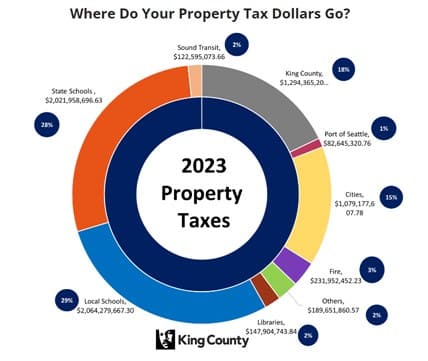

Wilson, who was reelected in 2019 to his second term and recently announced his bid for a third term, also provided an overview of how taxes are allocated in funding vital services, property tax limitations, and how his office advocates for property tax relief in Olympia.

Accredited appraisers from King County’s Department of Assessments (DOA) appraise approximately 720,000 commercial, industrial and residential properties, with all parcels physically inspected at least once during each six-year cycle. Within King County, there are 88 residential market areas and 155 taxing districts, such as schools, fire districts and parks. Tax districts are limited to a 1% annual increase in property tax revenue regardless of changes in property values. Voter-approved levies are not subject to the 1% restriction.

DOA calculates tax rates for nearly 600 levy codes.

Many factors are considered when setting values, according to Assessor Wilson. Location, market, condition, neighborhood, a properties’ effective age, zoning and probable use can affect values. In King County, three methods are used to determine values: market (comparable sales), income generation, or cost of construction (reproduction or replacement cost, less depreciation).

An increase in property value does not represent a dollar-to-dollar increase in property taxes, according to the Assessor’s website. In addition to assessed value, the total taxable property value in one’s community, voter-approved measures, and the budgets adopted by local governments affect the tax.

On average, Wilson said values for 2023 (for 2024 taxes) are up 21.8%, rising from $722.5 billion to $879.9 billion. Aggregate taxes for the county for 2023 increased by 6.4%, primarily due to voted measures. Considerable variation exists across jurisdictions. Among examples he provided were:

| City | Home price | % change in median home value | Taxes |

| Issaquah | $1,393,000 | Up 44.8% | $11,626 |

| Kirkland | $1,238,000 | Up 40.5% | $10,652 |

| Mercer Island | $2,432,000 | Up 35.8% | $22,047 |

| North Bend | $992,000 | Up 33.3% | $8,513 |

| Sammamish | $1,592,000 | Up 51.2% | $12,557 |

Sammamish had the highest property value increase in 2022. Because of the “budget based” system, the property tax increase for 2023 payments in this city was 24%, but to accomplish that, the levy rate actually decreased by -18% (-$1.72935 per $1,000 of property value).

Tukwila had the lowest property tax increase among cities in King County, at 1.3%. The median home value increased 16.7% in 2022. The levy rate dropped 13.2%, or -$1.59891 per $1,000 of property value.

The Assessor’s website has a summary of lid lifts, levies, and bonds passed in 2022 for the 2023 tax year.

As part of an effort to promote understanding of property tax measures, Wilson’s office introduced a “Taxpayer Transparency Tool” in 2018. (Ballot measures, such as sales tax measures or benefit charges, are not included). The map-based tool aggregates data. Users can enter a parcel number or address to see where their property tax dollars go and the estimated cost of any proposed property tax measure for forthcoming votes.

Wilson also provided Realtors with an overview of how taxpayers can apply for an exemption or deferral. The exemption is available to seniors, those who are SSI disability eligible, and disabled veterans. Seniors must be the owner/occupant of the home, age 61 at the time of application, and have a household income of $58,423 or less after approved deductions. Applications for exemptions or deferrals are available in several languages and may be made online or by mail.

In closing his presentation, Wilson highlighted some of the measures being supported for tax relief this legislative session, saying “we’re overdue for real property tax reform.” Among them are two bills (HB 1355 and HB 1343) that would expand eligibility for existing property tax exemption programs and property tax incentives to preserve existing affordable rental housing.